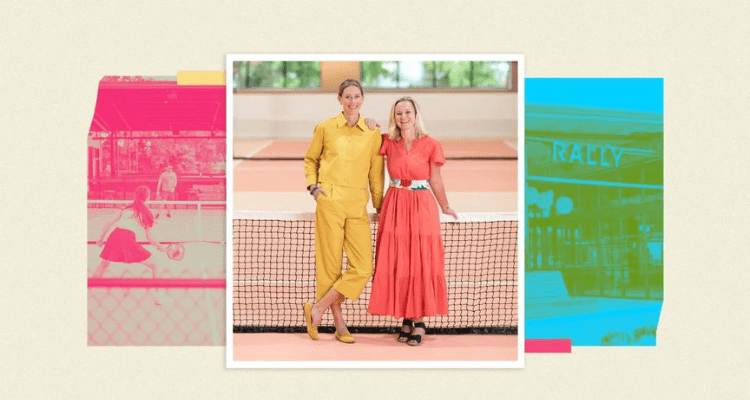

Pickleball Pioneers: Barrett Worthington and Meg Charity, co-founders of Rally, heard a group of noes and changed up their pitch to close the business.

Pickleball Pioneers: From Court Convos to $15M Investment

Co-founders Barrett Worthington, 37, and Meg Charity, 35, eventually got their first investor by enticing him to leave the office and onto the pickleball court, following more than a year of rejections.

According to Worthington, “It’s an icebreaker.” “It breaks down walls, and it sort of helps facilitate friendships and conversations.”

That meeting place was not just a ploy. All of it was included in their business proposal for a pickleball Pioneers social club. This past June, three months after the co-founders secured a $15 million seed investment, Rally opened its doors in Charlotte, North Carolina, realizing a five-year vision. Over 40,000 individuals visited the court within the first half-year, spending money on tacos, cold beers, spritzers, and court time. According to the business, 40% of those clients came back after 30 days, and last month, that percentage shot up to 75%.

Not just AI firms are securing amazing amounts of financing in this icy investment climate. The venture capital funding in the “eatertainment” market has continued to grow as customers, who are ravenous for in-person experiences, continue to spend in the post-pandemic services boom, even though it fell by 38% in 2023 to its lowest level in six years. The industry is expanding beyond Dave & Buster’s and bowling alleys. In between glasses of wine and baskets of wings, people may now curl, surf, and play ping pong.

Putting Profits: The Booming Business of Experiential Entertainment Investments

Investors are paying attention. Last year, Tiger Woods’s outdoor minigolf game, PopStroke, received support from golf equipment manufacturer TaylorMade, raising its valuation to an estimated $650 million. Meanwhile, Swingers, a chain of hip, cocktail-fueled indoor minigolf facilities that has even drawn the Real Housewives of New York cast, garnered $52 million.

Yelena Maleyev, senior economist at KPMG, notes that the economic facts clearly show this trend. Instead of purchasing material goods, Americans are opting to spend their money on experiences and travel. “Even in a high price environment, high-interest rate environment, people still feel like they’re able to spend, especially on necessities and experiences,” she explains. “Because they can make up some of those inflation losses with higher pay.”

Pickleball Pioneers: Making use of the pickle-boom

Charity and Worthington, who are lifelong friends in addition to business partners, agree that having trends on your side is not sufficient when starting a new venture. Finding the right audience, networking, persistence, and a combination of $10 million in loans and $5 million in equity were all necessary to raise their seed round.

Long before pickleball Pioneers became the nation’s fastest-growing sport, the two saw its ascent. To assist players connect with other locals for freelancing coaching, the two launched an internet platform in 2017 when Worthington was still a business school student. Think of it as Uber for tennis lessons. They soon saw tremendous growth on the pickleball side.

The idea was taken offline by the couple, who rented a courtroom and started holding “picklefests,” which were pop-up events featuring food trucks, live music, matches, and instruction. The co-founders claim that after that encounter, they began to consider how to grow this. What steps can we take to boost profitability? How do we get individuals to incorporate this idea into their daily routines?

“We started focusing more on the social and less on the instruction side, because we saw that was what resonated with people,” says Worthington. “As you get older and you graduate from college and enter the workforce, it becomes a lot harder to make friends and also to find those types of communities.”

Identifying your target and perfecting your pitch

The founders relied on Worthington’s connections at the University of Virginia’s Darden School of Business when they first started looking for investors. The co-founders seized every opportunity to arrange meetings, basing their argument on the analogous operations of Top Golf, the network of interactive sports bars and driving ranges that made the Inc. 5000 list three times in a row before Callaway Golf purchased the company for a $2 billion sum. The majority of the rooms were occupied by middle-aged white men in their fifties who were aware of Top Golf but weren’t as interested in Rally’s focus on community or wellbeing.

“It didn’t always resonate,” says Worthington. “The word wellness kind of took their minds down like a Gwyneth Paltrow Goop vibe.”

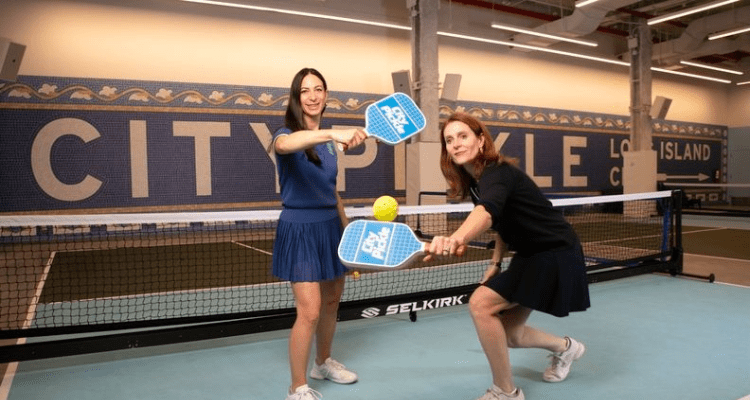

Nevertheless, the business owners always concluded their fruitless discussions by asking, “Is there anyone else you can introduce us to?” That series of introductions, after they were passed from one organization to another, resulted in their first pitch meeting on the pickleball Pioneers court and in meeting Cal Simmons, the chairman of the Tiger 21 angel investor group’s Washington, D.C. chapter, who is currently a board member of Rally.

Worthington says, “Having someone vouch for you is helpful.” “Getting our first willing and able investor to take a gamble took a long time…It gets much easier once someone is willing to enter, but the real difficulty lies in getting that first person in.”

Searching for local money

In addition to the typical locations of New York, Los Angeles, Chicago, and Washington, D.C., Rally’s investors also included smaller, more local sources of finance by enlisting the support of other Queen City small company owners. According to the co-founders, those local investors did more than just sign checks. They even bring their clients along when they come to watch matches. They intend to apply that “boots on the ground” approach in all upcoming areas.

Worthington and Charity raised $5 million in debt in addition to equity. The entrepreneurs tried unsuccessfully to get funding from traditional lenders and the Small Business Administration, just like many other businesses that have no history of making money. Rather than going with public debt, they chose private debt, “which is not a fun or easy thing to do, but it is what enabled us to get that $15 million,” states Worthington.

After almost eight months of operation, the co-founders of Rally report that sales are rising gradually and can be divided into three categories: events account for thirty percent, pickleball Pioneers for thirty percent, and food and drink for forty percent of total purchases. The creators refused to provide precise income figures.

Their greatest fantasy? Hopefully, on the pickleball Pioneers courts at Rally, assist other female founders in closing their fundraising rounds. Worthington states that “it should be the new golf in terms of being the foundation for business deals.”